Empowering Your Business With Solar – What Are The Tax Benefits In India?

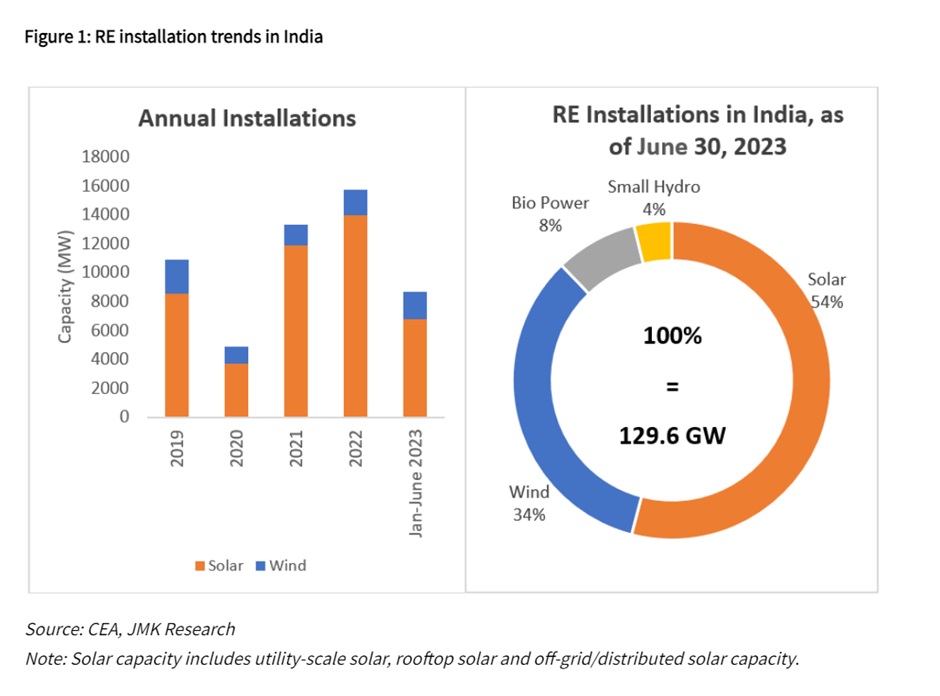

powernsun2023-11-04T10:55:09+04:00Recently, impressive growth records in renewable energy generation have been witnessed in India. The significant benchmarks of India include the installation of 1.4 GW of large-scale solar in Q1 2023. In addition, the nation has achieved 12,784 MW solar capacities for the period from April 2022 to March 2023. The overall cumulative installed capacity of India as of now stands at 67.07 GW.

Solar Energy in India

Renewable Energy Statistics 2023 indicates that India holds the fourth largest installed capacity of renewable energy. Moreover, the REN21 Renewables 2022 Global Status Report reveals the nation’s pride of being fourth in Solar Power capacity. The highest on-year growths are observed in 2022 with regard to renewable energy additions. There is a tremendous amount of installed solar energy capacity in the last 9 years, which has increased by 24.4 times and it stands at 67.07 GW as of July 2023.

With an overall renewable energy mark of 168.96 GW, 64.38 GW is the solar power capacity, meaning that it contributes nearly 53% of the overall capacity.

Solar for businesses in India

The increasing cost of non-renewable energy sources and the emerging demand for energy encourage businesses to look for energy-efficient ways to reduce their energy bills. Solar energy is certainly the right path for businesses in India. A commercial solar installation is an intelligent business move. Beyond providing clean and green energy, installing solar systems can do far more. With the cost-effectiveness of solar energy, adopting solar energy is no more a hassle for businesses.

Business owners can realize the benefits of solar energy for their businesses in bigger ways, which include:

- Obtains the potential to lower energy costs

- Our nation has a limited reserve of non-renewable sources of energy. By adopting solar power and generating their own electricity, businesses can contribute to the energy independence of India

- Generating electricity from solar means your business reduces the use of fossil fuel and leaves less carbon footprint.

- Investing in solar power gives businesses long-term savings and quick ROI.

- Ensures the business is less vulnerable to power cuts and outages, and thus improves overall productivity

- Businesses become less reliant on energy imported from the grid and hence improve the resilience of businesses.

Tax benefits for adopting solar in India

For those businesses looking to save money on their energy bills, there are immense tax benefits and subsidies offered by the Government of India. So, it is good for businesses to go solar without any hurdles. Let us look at the tax advantages for commercial solar installations.

Tax benefits

In order to motivate the adoption of solar energy in commercial and industrial segments, The Government of India has given accelerated depreciation. This is an excellent thing that encourages businesses to front-load the depreciation of their solar assets. As of now, the annual rate acceleration that businesses can claim is 40% for the first year. Furthermore, solar project developers can avail of the exemption from paying income tax for the first 10 years of existence of the project.

For the subsequent years, businesses can claim around 20% of the diminished value. This can be continued till the value of the asset is completely depreciated. The accelerated depreciation benefit for businesses offers the owners immediate tax savings and improved cash flows.

Net metering

The net metering programme allows commercial customers to generate electricity on their own and export the surplus energy back to the grid. The solar customers can generate and use the electricity during the day and this net metering scheme of the Government allows business owners to export the excess power to the grid and thus reduce their future electric bills.

Capital subsidies

The Government of India has a subsidy scheme which is very helpful for businesses interested in procuring solar energy systems at reduced capital costs. IREDA – Indian Renewable Energy Development Agency has implemented this scheme and it offers a 40% subsidy on the costs of capital related to solar systems, applicable to both rural and urban areas of India.

Goods and Services Tax (GST) Exemptions

GST exemptions are applicable to certain goods and services that are used in solar energy initiatives such as inverters, batteries, and solar panels. Since GST is being exempted for these products, it would be helpful in reducing the cost of procurement of such products. Thus solar energy products will become more affordable.

In addition, it is anticipated that the exemption on renewable energy goods and services would benefit the government in realizing its renewable energy capacity of 450 GW by 2030.

Renewable Energy Certificates (RECs)

These are the tradable certificates that are intended to reward bodies with cash incentives for those bodies that produce green energy. The Central Electricity Regulatory Commission issues these certificates and it helps to accomplish carbon neutrality for the commercial and industrial sectors.

Reduction in import taxes

India is thinking of bringing a reduction in import taxes on solar panels which will certainly address the emerging demand for solar energy projects. The Government is planning to cut down the import tax from 40 % to 20 % and it would help in lowering the GST levied on solar panels to 12% (which is 12 % earlier).

Conclusion

India is enthusiastically interested in investing in renewable energy projects, especially solar energy. On the way to this, the Government has initiated many schemes and incentives for businesses that will empower them to go solar and become independent in energy generation. The above-mentioned tax benefits are some of the initiatives through which India is promoting sustainable growth of solar energy and fostering the adoption of solar among businesses.